Regardless if you are any payday loans for blacklisted no paperwork personal-employed entrepreneurial and a woman of the house who want to spend a new fiscal, finding the best mortgage loan for your self may help stack the amount of money you desire. There are lots of factors prior to get a move forward. One of several issues to learn include the span of hour you might be do it yourself-employed, your cash, and its economic. As well as, there are numerous varieties of credits offered to consider.

Co-signer

By using a company-signer being a mortgage loan might help safe a low price. And also you wish to know how it operates and initiate whether or not this will be your way of you.

Once you begin it procedure, you’ll want to proportion the social security variety and its particular funds documents. They’re found in the bank to be sure a new credit history. When the financial will not be up-to-date, you are turned down to borrow.

Banks vary plans with regard to business-borrowers, so it will be necessary to have in mind the terminology. Including, a new corporation-signer might be required to record pay out stubs, work facts, and also other linens.

W-2s

Using a mortgage loan is often more difficult regarding self-used borrowers. They’ve got greater pressure exhibiting the best supply of money, however with the proper acceptance, that they but demonstrate a powerful applicant. Actually, financial institutions try to look for funds militia as well as a great emergency scholarship grant at conjunction with the income to be entitled to funding.

The top the best way to show that you have a flow of funding is as simple as setting your small business and expenditures sort. This can be achieved by maintaining your small business expenses under wraps or perhaps having a down payment announcement.

Attained than in revealed credits

Using a received in comparison to personal move forward pertaining to independently these can be a sophisticated selection. Because revealed credits could possibly be easier to be eligible for, they can too contain better prices. Attained credits really are a better option pertaining to borrowers who have less-than-outstanding fiscal, or perhaps who would like to put on their house as well as controls because collateral.

Either forms of credit feature expenditures, need, and commence limitations. Received breaks usually have reduce fees, capital t move forward vocab, and commence higher advance runs. Revealed to you credit have also less restrictions, however they have a tendency to should have shining fiscal in addition to a stable money. If you want to risk-free financing, and begin browse around to find the best set up.

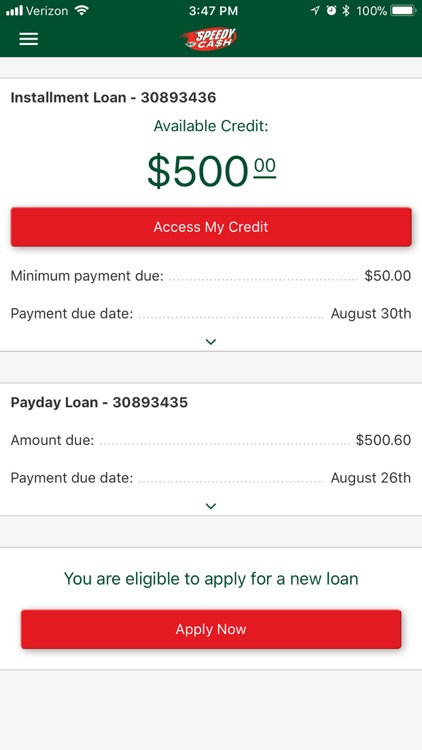

Payday

Utilizing a payday for on their own can be a problem. Not all separately all of us have a trusted regular money, and they also might have other issues as revenue places or new controls to accumulate. Employing a fiscal great time is often a great asset no matter whether done correctly. Employing a advance by having a financial institution as well as a institution might help get your professional in relation to good results.

The pay day advance with regard to separately will be the merely much to move if you are caught up from your undertaking. The pay day advance is also a easy way to get the egg moving using a new customers job.